- The MACD is significantly below its signal line which suggests that the existing bearish sentiment is beginning to swing around toward a more bullish outlook.

Over the last 7 days, CAC 40 has fallen 2.43%. Yesterday's session continued down the same path: CAC drops 1.78% to close at 7,187.27 yesterday.

The index has been trending positively for about 2 months. CAC 40 hit a significant low of 15.42 around 5 months ago, but has since recovered 47,354%.

The MACD is significantly below its signal line, which suggests the market is running out of bearish momentum and could revert to a positive outlook as bulls regain control.

Technical analysis indicates that CAC 40 (currently on a downtrend) might reverse course and start pointing upward in the short term.

Fundamental indicators – Germany GDP fell short of the -0.2 projections, with new data of -0.4.

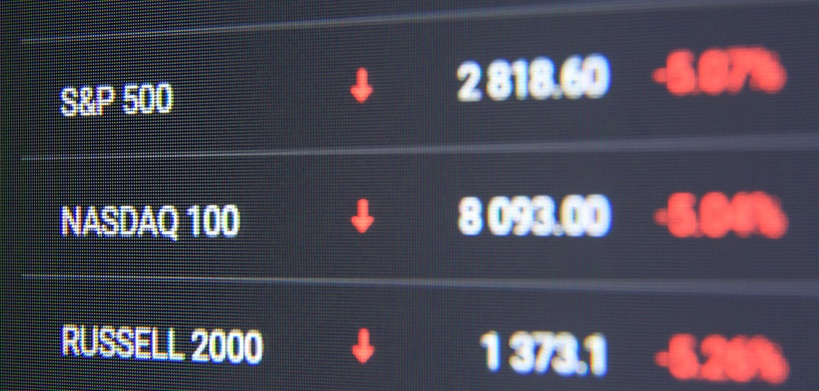

In the meantime, negative performances are also seen in other markets, after ending yesterday's session at 15,476, DAX lost 275.69 points and is trading around 15,200. EuroSTOXX lost 1.86% yesterday and closed at 4,258. Hang Seng is down to 20,000, losing 351.35 points, after ending the previous session around 20,351.

|

|  February 25, 2023

February 25, 2023