A quick look at yesterday: the Nikkei dropped 479.18 points early on and stayed at 28,144.

Investor risk appetite was subdued as stocks were sold off in favour of perceivably safer alternatives such as government bonds. The iShares U.S. Treasury Bond ETF has gone up 1.41% to trade at $23.05, thereby indicating that government bond yields were downbeat across the yield curve.

While price action maintains a negative bias, Japan CFTC JPY speculative net positions released yesterday at 20:30 UTC with a figure of -34,000, while the previous figure was -29,100. Japan Interest Rate came out at -0.1, while a consensus of analysts was expecting -0.1.

Nikkei made an initial break below its 5 day Simple Moving Average at 28,258, a possible indication of a forthcoming negative trend. The Nikkei's upper Bollinger Band® is at 28,655 which indicates a further downward move may follow. On the other hand, note that the Nikkei could begin to recover as it approaches significant support, now 124.81 points away from 28,019. Dipping below could be an indication that further losses are ahead.

Several technical indicators are adding weight to the bearish momentum seen yesterday and forecasting the Nikkei to extend its recent losses.

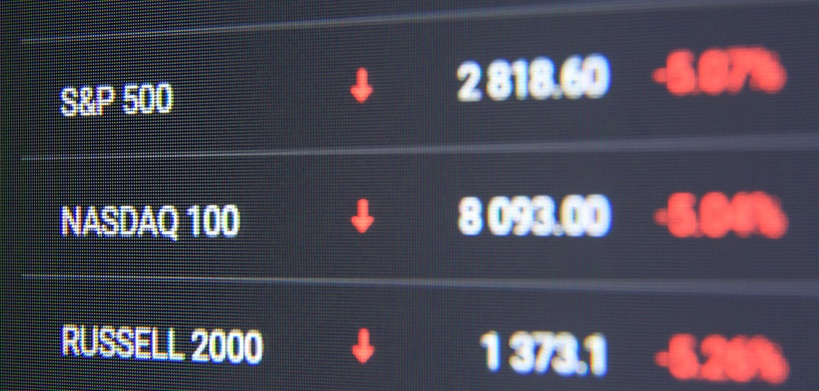

In the meantime, negative performances are also seen in other markets, after ending yesterday's session at 7,311, ASX 200 lost 166.3 points and is trading around 7,144.7. Hang Seng lost 3.04% yesterday and closed at 19,926. FTSE drops 1.67% yesterday and closed at 7,880.

Furthermore, Japan BSI Large Manufacturing Conditions (Q1) is expected tomorrow at 23:50 UTC.

The index has been trending positively for about 2 months. The Nikkei hit a significant low of 15.42 around 5 months ago, but has since recovered 185,524%.

|

|  March 11, 2023

March 11, 2023