- The FTSE's nearest resistance stands at 7,687.4 followed by 7,823. For support, there is 7,410.3 and 7,204

- The MACD is significantly below its signal line, which suggests the market is running out of bearish momentum and could revert to a positive outlook as bulls regain control.

While in the midst of a 17 day downtrend, Today's positive session could indicate a brief correction amid a broader downtrend, or, the start of a potential reversal. Marginally higher but lacking a clear-cut direction, the FTSE is trading at 7,381.79 after ranging between 7,344.45 and 7,458.64 today.

Having set a significant high of 8,012.53 28 days ago, the FTSE is trading 8.34% lower.

The MACD is significantly below its signal line which suggests that the existing bearish sentiment is beginning to swing around toward a more bullish outlook. The FTSE's lower Bollinger Band® is at 7,577.75, indicating that the market is oversold and fertile for new buyers.

The FTSE continues to move higher with technical analysis indicating the trend will continue in the short term.

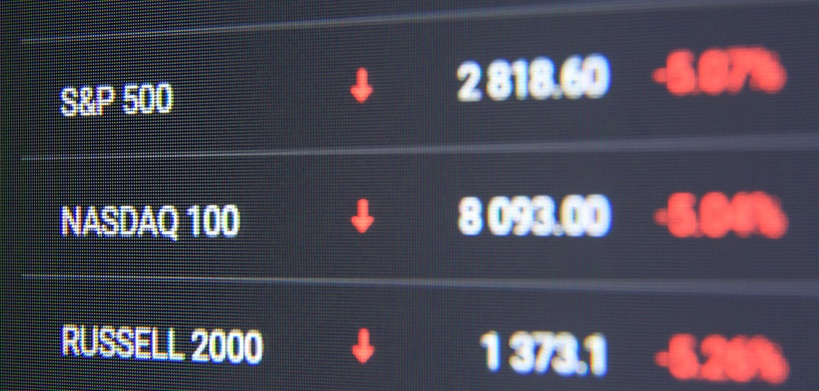

At the same time, ASX 200 drops 1.46% to trade around 6,965.5. Hang Seng is down to 19,200, losing 339.87 points, after closing at 19,540 in the preceding trading session. Dow Jones goes down 0.87% to trade around 31,875.

Upcoming fundamentals: United Kingdom CFTC GBP speculative net positions will be released tomorrow at 20:30 UTC.

|

|  March 16, 2023

March 16, 2023