- Next support is currently 32 cents away at $42.78

- The lower Bollinger Band® is currently at $41.35 while the higher band is at $53.79

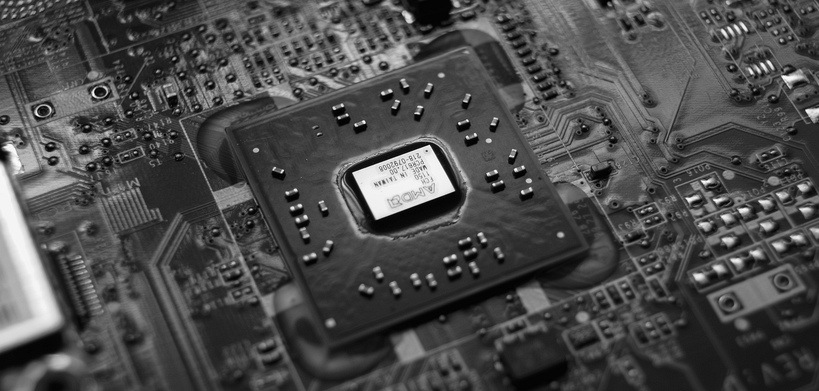

STMicroelectronics is on a 5 day downtrend With a marginal improvement upon yesterday's session, STMicroelectronics was steady yesterday maintaining a $42.9 – $43.65 range before closing at $43.1.

On a negative trend for around a month. The Dutch tech company is now trading 19.67% below the significant high of $53.49 it set around a month ago.

Trend-focused traders would be interested to note that the Commodity Channel Index (CCI) indicator is below -100, meaning the market price is unusually low and below its rolling moving average. Technical analysis indicates that a new, strong downtrend could be forthcoming with short positions favored. Analysis based on the asset volatility indicates that STMicroelectronics's upper Bollinger Band® is at $53.79 and the lower is $41.35. Support/Resistance levels obtained from chart analysis indicate that STMicroelectronics is approaching key support, around 32 cents away from $42.78. Dipping below could indicate further losses are ahead while a failure to break below this level is likely to be seen positively by market bulls.

The current technical outlook indicates STMicroelectronics will continue to ebb sideways within tight ranges for the immediate future.

Fundamental indicators – United States JOLTs Job Openings (Mar) released yesterday at 14:00 UTC with a figure of 9.59 million, while the previous figure was 9.97 million.

Meanwhile, mixed performances were seen by other technology stocks as Cisco Systems closed at $46.36 (down 2.07%). Intel went down to $29.77, losing 1.75% after it closed at $30.3 yesterday. Salesforce went down to $193.84, losing 2% after it closed at $197.79 yesterday.

Upcoming fundamentals: United States Crude Oil Inventories is projected to outperform its last figure with -1.1 million, having previously been at -5 million. The figure will be published today at 14:30 UTC.

|

|  May 03, 2023

May 03, 2023