HANG SENG INDEX is down to 19,248, after ending yesterday at 19,700. Overall, a 2.27% loss or 452.04 points today.

Investor risk appetite was subdued as stocks were sold off in favour of perceivably safer alternatives such as government bonds. Inversely correlated to prices, yields on one year US government debt fell to 4.3%.

The Commodity Channel Index (CCI) indicator is below -100, meaning the market price is unusually low and below its rolling moving average. Technical analysis indicates that a new, strong downtrend could be forthcoming with short positions favored. HANG SENG INDEX has just crossed the lower Bollinger Band® at 19,323, indicating further losses could be forthcoming.

Overall, looking at the technical analysis landscape, it seems HANG SENG INDEX is likely to start pointing downward in the short term.

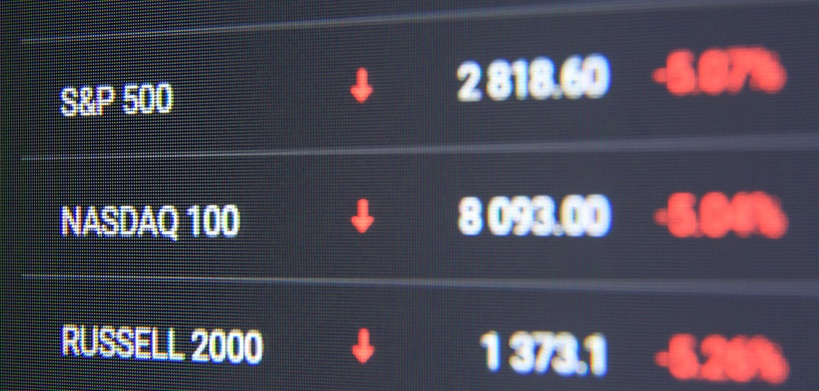

In the meantime, negative performances are also seen in other markets, KOSPI Composite Index tumbles 2.56% to trade around 2,349. After ending yesterday's session at 27,833, Nikkei lost 610.92 points and is trading around 27,222. ASX 200 dips 1.41% to trade around 7,009.

Approximately a month ago, HANG SENG INDEX reached a significant high of 22,700 but has struggled to hold onto its gains and declined 13.19% since then.

|

|  March 14, 2023

March 14, 2023